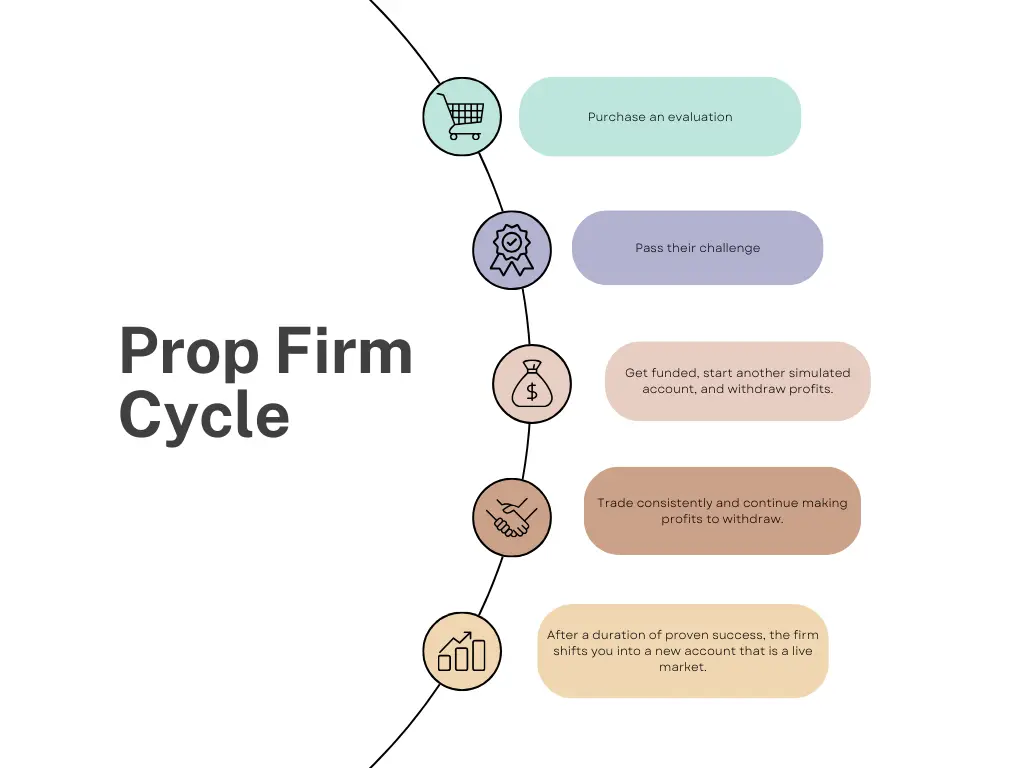

A prop firm is a company that provides its traders with access to capital, in return for a percentage of the profits generated.

They provide you with a simulated account for you to trade on and for you to hit a specified profit target without hitting their maximum loss while following their set rules and guidelines.

Simulated Evaluation Phase: In this preliminary phase, your trading capabilities is put to the test. A virtual demo account with a predetermined balance is assigned to you, challenging you to reach a specific profit target within the limits of an allowable drawdown, all while adhering to a set of trading rules.

Simulated Funded Phase: At this critical stage, the primary goal is to demonstrate consistent and reliable trading over a set period, in accordance with the payout structure. It’s essential to prove that you can maintain profitability within a simulated environment. Notably, any profits generated during this phase are genuine and can be withdrawn.

Live Funded Phase: Upon reaching this pinnacle, a live trading account is bestowed upon you, indicating a strong confidence in your trading discipline and strategy. This stage immerses you in real-market scenarios where you operate with actual funds. The aim here is to conduct trading with responsibility, achieve tangible profits, and cultivate growth within the account.

End of Day (EOD) Drawdown: This type of drawdown is assessed at the end of the trading day. If a new high in the account balance is achieved at the end of a session, the drawdown limit is adjusted upwards. However, what happens during the day does not affect the drawdown unless it’s violated, leading to account termination. This approach allows traders some flexibility during the trading day, as the drawdown limit only updates based on the end-of-day account balance.

Unrealized Trailing Drawdown: In this type, the drawdown is constantly adjusted based on the highest reached balance, including unrealized profits and losses from open positions. This means if a trader’s open position shows a significant profit, the drawdown limit trails this profit, reducing the amount of drawdown available. This type of drawdown is more challenging as it requires traders to be very mindful of their open positions and the impact they have on the drawdown limit.

Static Drawdown: Static drawdown is the most straightforward and trader-friendly type. In this setup, the drawdown limit does not change regardless of the account balance. It remains fixed, offering a clear and unchanging target for the trader to manage. This type of drawdown is generally preferred by traders because of its simplicity and predictability.

The account starts with a balance of $50,000. (Ex. 2.5k EOD Drawdown)

An End of Day (EOD) trailing drawdown is distinct in that it is assessed based on the account balance at the close of the trading day. This system incrementally adjusts the drawdown threshold each day, aligning with the end-of-day balance, and continues to do so until the trader’s net profits surpass the specified drawdown limit. Once this happens, the trailing aspect of the drawdown stops trailing and the starting balance is the drawdown limit, allowing you to build a cushion.

For example, if on the first day, a trader realizes a profit of $2,000, the EOD trailing drawdown would adjust accordingly. Assuming the account started with a balance of $50,000 and an allowable drawdown of $2,500, the new account balance of $52,000 would shift the drawdown threshold to $49,500. This maintains the $2,500 drawdown allowance. However, because the drawdown continues to trail the closing balance, if the account balance falls to $49,500 (which is only $500 below the starting balance), this would constitute a breach of the drawdown limit. Unlike a fixed or static drawdown, the EOD trailing drawdown offers less room for downturns, as it is sensitive to the daily ending balance, underscoring the necessity for careful risk management.

The account starts with a balance of $50,000. (2.5k Unrealized Trailing Drawdown)

The key to understanding an unrealized trailing drawdown lies in recognizing that it is always calculated from the highest peak value of the account balance, regardless of the eventual outcome of the trade. This method does not consider whether the trade was ultimately less profitable or even if it closed at a loss compared to the highest point of unrealized profit.

For instance, consider a scenario where a trade momentarily reaches an unrealized profit of $2,000, pushing the account balance to a peak of $52,000. However, later fluctuations lead to the trade closing at break-even. Despite this, to calculate drawdown, the peak figure is what matters. Hence, the trailing drawdown would still consider the $52,000 as the peak balance. If the set drawdown limit is $2,500 below the peak, the new failure threshold for the account becomes $49,500. Therefore, even after closing the trade without a profit, the available drawdown cushion is reduced to just $500. This tightens the risk parameters and highlights the need for vigilant trade management under a trailing drawdown system.

The account starts with a balance of $50,000. (2.5k Max Drawdown)

A Static Drawdown is characterized by its fixed nature, as it is set based on the initial account balance and does not adjust over time with daily trading results. This type of drawdown provides a consistent risk threshold that does not fluctuate with the account balance, offering a clear and stable target for traders to manage their risk. The static limit remains in effect regardless of any profits or losses incurred, which can be advantageous for traders as it offers a known quantity to work with allows for strategic planning of trade sizes, and stops losses.

For example, if a trader starts with an account balance of $50,000 and the permitted static drawdown is $2,500, the failure threshold is set at $47,500. Should the trader make a profit of $2,000 on the first day, increasing the account balance to $52,000, the static drawdown limit would remain at $47,500. In this case, the trader now has a larger cushion of $4,500 above the drawdown limit. Conversely, if the trader experiences a loss on any given day, the static drawdown limit does not change, preserving the predetermined risk level. This fixed approach to drawdown management is less sensitive to daily account balance changes, which can reduce the pressure on traders to adjust their strategies frequently. It is especially beneficial for those who prefer consistency and predictability in their risk management tactics.